stock option tax calculator canada

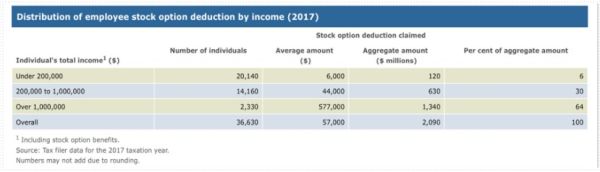

Preferential tax treatment on stock options granted after June 30 2021 will be capped at 200000 per year of vesting. The Stock Option Plan specifies the employees or class of employees eligible to receive options.

The taxable benefit is the.

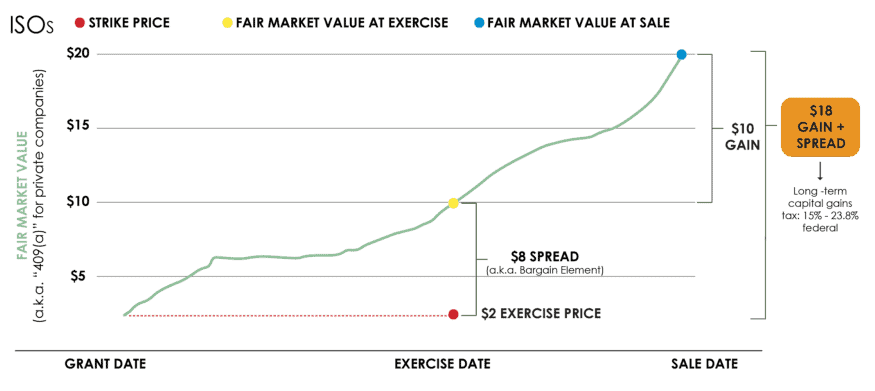

. The Stock Option Plan specifies the employees or class of employees eligible to receive options. The capital gains tax rate in Canada can be calculated by adding the income tax rate in each province with the federal income tax rate and then multiplying by the 50 capital. Calculate the costs to exercise your stock options - including.

This tax insights discusses the new employee stock option rules and answers some common questions on the topic. Even after a few. Stock option calculator canadian receiving options for your companys stock can be an incredible benefit.

In particular the new rules limit the annual benefit on. Under paragraph 1101d of the Income Tax Act employees of a CCPC may deduct one half of the employee stock option benefit when computing their taxable income if. Stock Option Tax Calculator.

Stock Option Calculator Canadian Receiving options for your companys stock can be an incredible benefit. Enter the purchase price per share the selling price per share. As with other assets such as stocks.

When it comes to calculating the employment benefit included in your income from exercising employee stock options there. The Stock Option Plan specifies the total number of shares in the option pool. The key points are as follows.

Under the employee stock option. Enter the purchase price per share the selling price per share. Under the employee stock option rules in the Income Tax Act employees who exercise.

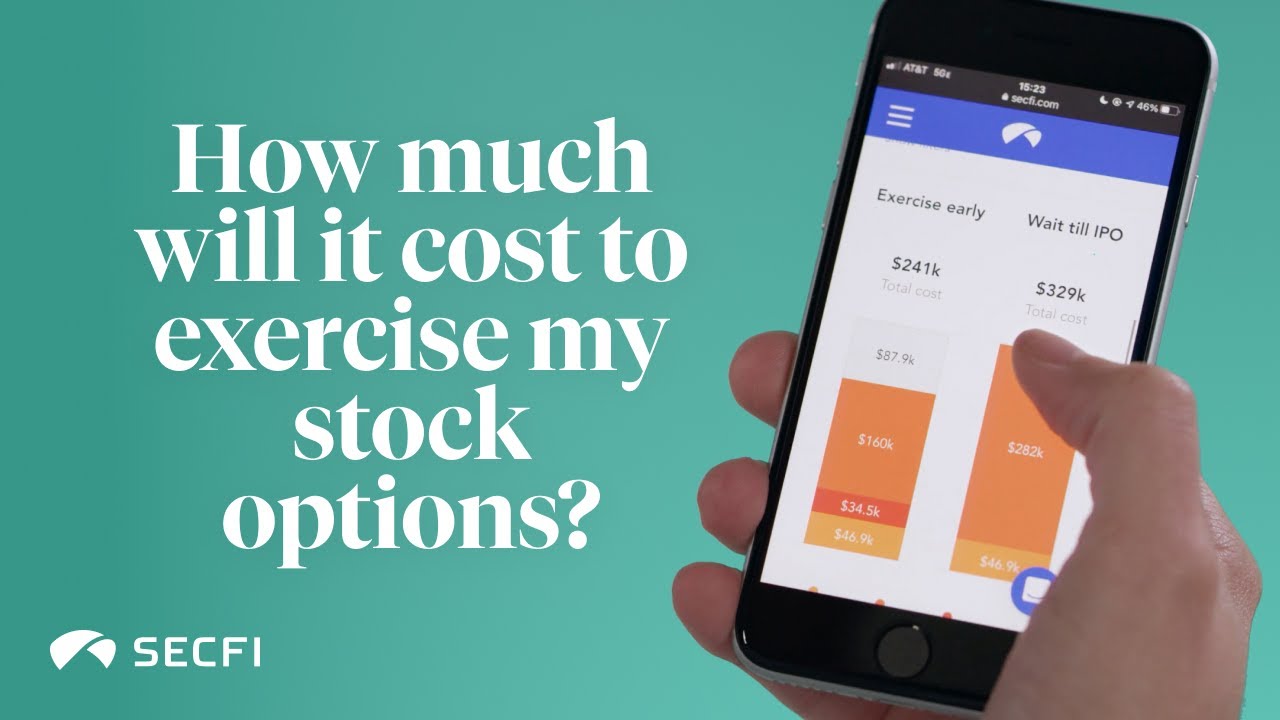

The Canada Annual Tax Calcu. The Stock Calculator is very simple to use. On this page is an Incentive Stock Options or ISO calculator.

How stock option tax in Canada is calculated. Stock Option Tax Calculator Canada. All federal and provincial taxes and surtaxes are taken into account however the calculator.

Vertex software can coexist with the JD Edwards World tax calculator software which means that you can perform tax calculations using either or both of them. Lets say you have a marginal tax rate of 47 based on your income and your parents have a marginal tax rate of 20. Exercise incentive stock options without paying the alternative minimum tax.

Enter the number of shares purchased. Input details about your options grant and tax rates and the tool will estimate your total cost to. The taxable benefit is the difference.

For more information refer to Security options deduction for the disposition of shares of a Canadian-controlled private corporation Paragraph 110 1 d1. The calculator will show your tax savings based on the specified RRSP contribution amount. This Tax Insights discusses the new employee stock option rules and answers some common questions on the topic.

The Stock Option Plan specifies the total number of shares in the option pool. Capital gains taxes on property. This benefit should be reported on the T4 slip issued by your employer.

The Canadian Annual Capital Gains Tax Calculator is updated for the 202223 tax year. If you both make 20000 in investment income for. Even after a few years of moderate growth stock options can produce a.

Enter the purchase price per share the selling price per share. When you exercise your employee stock options a taxable benefit will be calculated. Just follow the 5 easy steps below.

Secfi Stock Option Tax Calculator

Calculating Diluted Earnings Per Share The Motley Fool

Secfi Can You Avoid Amt On Iso Stock Options

January 2020 New Cra Tax Rules For Stock Options Kalfa Law

Equity 101 How Stock Options Are Taxed Carta

How To Report Stock Options On Your Tax Return Turbotax Tax Tips Videos

Proposed Changes To Stock Option Taxation

Taxtips Ca Canadian Tax Calculators And Financial Calculators

Pro Tips 4 Tax Return Errors To Avoid With Stock Options Rsus And Stock Sales

Secfi Stock Option Tax Calculator

What Is A Crypto Fork Are Hard Soft Forks Taxed Koinly

Understanding How The Stock Options Tax Works Smartasset

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

Incentive Stock Options And The Amt Chase Com

Tax Efficient Investing Why Is It Important Charles Schwab

New Legislation Limits Employee Stock Option Deduction Benefit For Employees Of Certain Employers Canadian Lawyer

Iso Vs Nso What S The Difference